Vise is Fueling the Trillion Dollar Enterprise RIA Revolution

4 min read

|

September 18, 2024

Our platform assets, which include both Vise’s managed assets for RIAs and assets on the Vise for Enterprise RIA platform, have surged to over $3.5 billion, a 350% increase since the start of this year. Today, we’re launching a revolutionary Enterprise RIA platform, now serving some of the largest RIAs in the U.S., and expanding our leadership with senior talent from Blackrock, Invesco, and Edelman Financial Engines.

The Great Wealth Consolidation

A tectonic shift is reshaping wealth management. The average age of a financial advisor in the U.S. is 60, and many of them are considering selling their practices and focusing on succession planning.

Over the past several years, Enterprise RIAs have emerged as the primary acquirer of these firms. Backed by tens of billions in private equity investments, these Enterprise RIAs have consolidated over $2 trillion in assets under management, with projections to reach $10 trillion over the next decade.

Their playbook is straightforward: acquire high-performing RIA firms at competitive prices, centralize operations, and leverage economies of scale to drive outsized growth and profitability.

After making an acquisition, these Enterprise RIAs confront a ticking clock: the faster they can transition newly acquired firms to a centralized investment approach, the more efficiencies they can extract.

The key to winning this race — and avoiding millions in lost revenue — lies in balancing centralized efficiency with personalization at scale. Enterprise RIAs who fail to achieve this risk missing out on the economies of scale critical to their acquisition strategy.

The Centralization Dilemma

Imagine acquiring an RIA firm and then facing the daunting task of integrating its portfolio management practices into a centralized investment framework. This process is not just time-consuming — it’s a potential minefield riddled with complexities.

Pre-acquisition: Advisors invest significant time and resources crafting personalized portfolios tailored to hundreds of clients' investment objectives, tax considerations, and risk profiles—an unscalable process.

Post-acquisition: Transitioning newly acquired legacy portfolios into standard models post-acquisition forces advisors to explain a new investment philosophy to their clients, potentially eroding hard-earned trust.

Enterprise RIAs face a difficult dilemma: They must drive efficiency and scale without sacrificing the personalization that clients demand.

The Missing Piece: Vise’s Platform Delivers Both Centralization and Personalization at Scale

What if Enterprise RIAs didn’t have to compromise?

We built the first-ever enterprise platform that addresses the core challenge facing Enterprise RIAs: how to centralize investment management and operations while powering the personalization that clients demand. Vise transforms what was once thought impossible into a seamless reality.

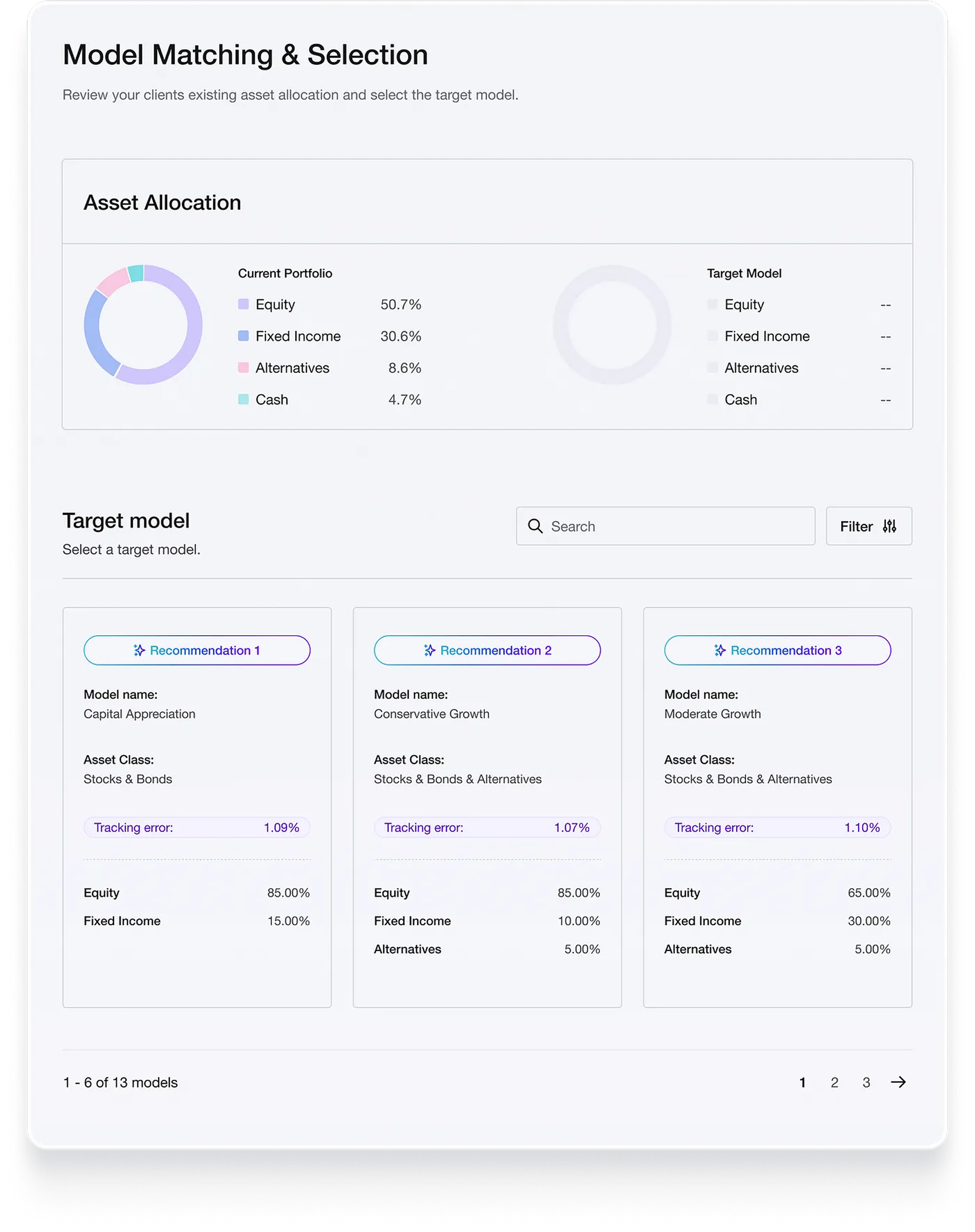

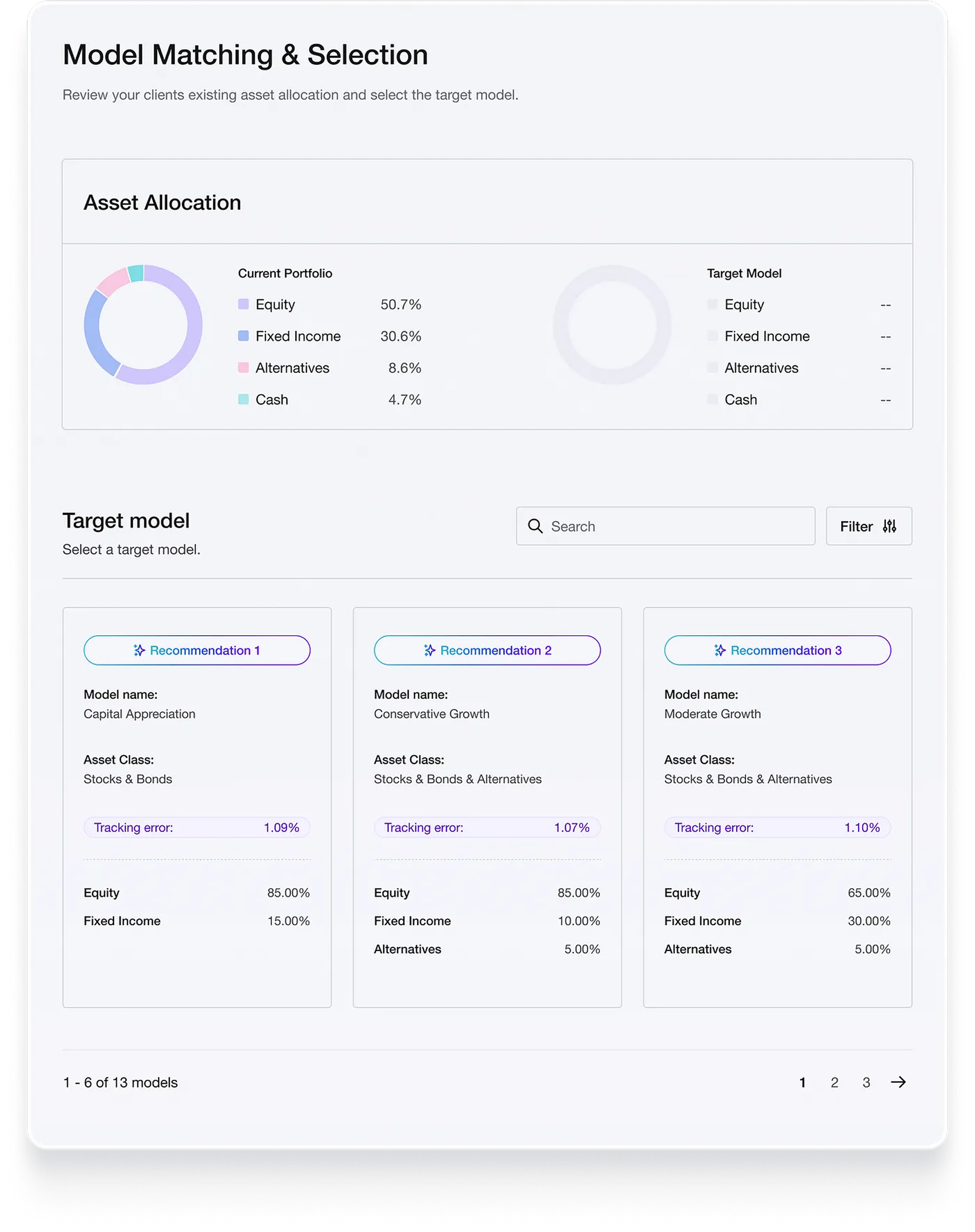

Vise can ingest home office investment models and deliver them efficiently

Our platform effortlessly integrates an Enterprise RIA's investment models, including both advisor and home office strategies. This integration streamlines the adoption of centralized models across the entire organization, all within a unified workflow.

For Enterprise RIAs acquiring other firms, this capability is invaluable in retaining newly acquired clients — allowing for smooth transitions of their portfolios into the RIA's preferred models.

Vise can deliver personalized versions of your models to meet clients’ preferences

Vise delivers strategies across nearly all asset classes, including equities, fixed income, and alternatives to power centralized models at scale. The platform also provides solutions to address complex tax situations, locked positions, ESG restrictions, and direct indexing, all within a single account.

This comprehensive approach is a scalable solution that replaces an Enterprise RIA's disparate technology stack, all within one platform.

Tech Stack Before and After Vise

Vise’s New Leadership Team Fuels Our Next Stage of Growth

We have rapidly established ourselves as a critical player in the market, partnering with three leading Enterprise RIAs that each manage tens of billion in AUM. Additionally, our platform assets have surpassed $3.5 billion, a 350% increase since the start of this year.

To capitalize on the extraordinary opportunity ahead, we’ve made key additions to strengthen our leadership team:

Larry Raffone — Current Chairman and former CEO of Edelman Financial Engines — Barron’s #1 independent financial advisory firm in the U.S. with approximately $300B in AUM. Larry joins Vise as an Executive and Board Advisor focusing on distribution and partnerships.

“After leading a $300 billion independent advisory firm, I’ve witnessed the challenges advisors and aggregators face in delivering investment personalization while scaling their businesses. The future of our industry depends on mastering this balance, and I’m excited to join Vise, a company uniquely positioned to help aggregators achieve this with unprecedented efficiency.”

Larry Raffone, Chairman of Edelman Financial Engines

Andrew Waisburd, PhD — Former Head of Invesco’s Global Indexing business. Andy now serves as Vise’s Co-Chief Investment Officer alongside Travis Fairchild, previously a Partner and portfolio manager at O’Shaughnessy Asset Management, where he was instrumental in building the Canvas platform, later acquired by Franklin Templeton.

Chip Roame — Founder of Tiburon Strategic Advisors and the former chairman of Envestnet. Chip is a strategic advisor at Vise and helps navigate the wealth management landscape while driving new strategic partnerships.

The Future of Wealth Management: Personalized Investments at Scale for Every Investor

With Vise, a single advisor can exponentially scale their practice, providing deeply personalized portfolios for all of their clients—powered entirely by technology. Our long-term vision is to serve thousands of independent RIAs and aggregators and millions of households in the coming years.

Vise AI Advisors, LLC ("Vise") is an investment adviser registered with the U.S. Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of Vise by the Commission.